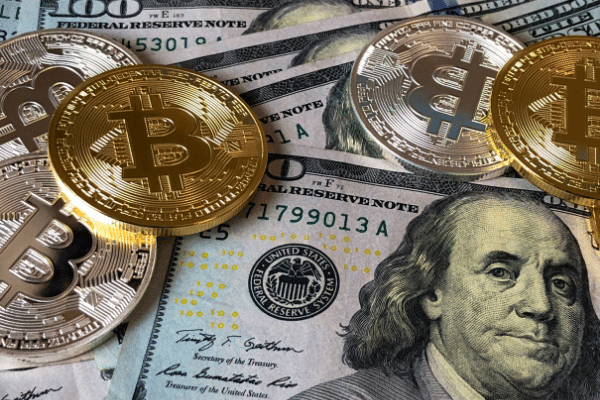

Everyone knows the cryptocurrency market is on a tear. Prices of Bitcoin, Ethereum, DeFi tokens, BNB and so on are multiples of what they were back in 2020.

Volumes across all crypto exchanges have also hit record highs. For example, Binance’s daily spot trading volume was between $1 billion to $4 billion throughout most of 2020 before averaging around $30 billion daily today.

What has changed? For sure, there are more retail traders coming into the fray. But, inadvertently, with such high volume, sophisticated traders and hedge funds are coming to “play” as well. Like sharks circling around a bloodied prey, these professional traders employ algorithmic and quantitative strategies to get an edge over the average folks.

One of the age-old strategies is market short. Typically, most of us would buy low and aim to sell high for a profit. However, someone who shorts an asset typically would sell first at a high and hope to buy back at a lower price – the exact opposite. A short seems to contradict the very nature of a growing market and to a certain extent, a trader whose main strategy is executing market shorts, is not that well-liked by those who trade on long positions.

But market shorts are necessary for an efficient capital market to function. It aids in price discovery especially in the crypto space when the value of a digital asset is hard to derive at since for many projects there is little to no revenue and even if there is, there is no mandatory reporting requirements like those instituted in regulated capital markets.

Most of the crypto traders are just trading based on mostly technical and quantitative data. Someone who feels that a digital asset has risen to frothy level may decide to sell-down. This process allows someone with the opposing view to buy up the shorts. This price wrestling helps in the price discovery process. Consequently, if most of the traders feel that the asset is indeed overpriced, the one who initiated the short would have done everyone a favor by calibrating the price of an asset.

Without a market short, the price of a digital asset may keep on rising undeterred. A huge bubble would form and a very painful correction would ensue.