-

Fiscal stimulus is stoking a reflation trade into banks and energy sector stocks, while pandemic themed winners such as tech are correcting

-

Rotational trade may be premature as the pandemic is far from being beaten, with pricing more aspirational than reflective of actual conditions

But as effective vaccines against the coronavirus were developed, that tech and Treasury trade has been complicated by a spike in U.S. Treasury yields, at a time when investors are growing more concerned over inflation.

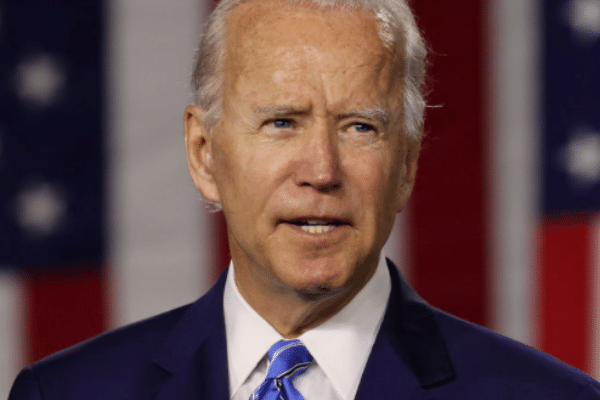

And now that U.S. President Joe Biden’s US$1.9 trillion stimulus package is being rolled out, tech stocks are falling out of favor at a time when the sectors which languished during the pandemic are starting to rise to the fore.

Stocks of banks and energy companies, which had been battered during the pandemic, are now shaking up indices from Frankfurt to New York.

Economically sensitive stocks such as banks have seen a surge in investment flows with MSCI’s index of developed economy lenders surging by 30% in the last quarter of 2020 and a further 20% this year alone.

Expectations that the U.S. will return to a strong semblance of normalcy by July this year, has fueled a reflation trade that has seen investors bet on banks as interest rates have soared. Industrials, commodities and consumer goods are also looking good as investors price in a sharp upswing in pent-up U.S. demand.

And followers of legendary value investor Warren Buffett will take comfort that things are finally turning their way, with MSCI’s global value index, which tracks companies that trade at low levels compared with measures of their fair value, rising some 8.7% since the start of the year, and hitting an all-time high last Thursday.

The stars of the pandemic are also falling back to earth, including electric vehicle maker Tesla, home exercise bike Peloton, e-commerce giant Amazon and graphics chipmaker Nvidia.

But it may yet be too soon to write off these pandemic heroes just yet. For starters, the experience in Italy demonstrates the virality of new coronavirus variants, as that country heads back into lockdown.

And even as vaccinations get underway in earnest in the United States, a large swathe of the population continues to resist the vaccine, even as more states are loosening pandemic restrictions.

Even though coronavirus case numbers in the U.S. are falling, they continue to be high, and if complacency were to set in, the U.S. may witness a dreaded second wave of infections, with as many as 30% of new infections now being attributed to the virulent strain of the coronavirus first discovered in the United Kingdom.

And many of the business practices that were forced by the pandemic may continue to prove to be durable, including remote work practices and video conferencing. As such, the demand for chips, for a variety of data applications and the Internet of Things is likely to remain high even after the pandemic subsides (it’s not likely to ever go away completely).

To be sure, there’s more than an outside chance that value plays will outperform growth in the ensuing period, but investors may be pricing in too much optimism over a return to normalcy – the prospects are good, but the proof is in the pandemic numbers, which so far, remain historically high.