To the uninitiated, markets may seem no more predictable than Brownian motion. But is there a divinity that shapes our ends, rough hew them how we will?

Peter Deringham glanced at his watch for the second time that day, noticing that the time “11:11” had been displayed digitally. It was a pattern that seemed to be repeating itself all day that day.

When he glanced at the clock in the local diner, “3:33,” later that evening at the local bar, “5:55.” Had it happened perhaps once or twice that day, Deringham would have dismissed it as coincidence, but now he was starting to wonder.

Because the following day, he received a string of good news — a promotion he had not been expecting, his wife confirmed her pregnancy after years of trying and his floating rate mortgage had come down.

Lately, it seemed that every time he noticed repeated numbers when checking the time — good things were likely to follow — so much so that Deringham, who for all intents and purposes was a right and cynical legal officer, started to count on these occasions as omens.

But the question is, were the times that Deringham noticed the cause of his subsequent good fortune or a signal that good things were about to happen? Does the tail wag the dog?

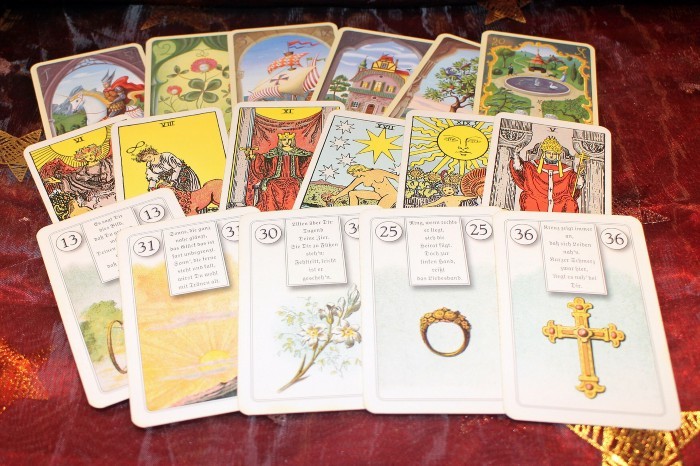

Does our noticing of certain events portend the future? Can we really read tea leaves or tarot cards?

Quantum physicists seem to think so.

“Quantum theory yields much, but it hardly brings us close to the Old One’s secrets. I, in any case, am convinced He does not play dice with the universe.”

— Albert Einstein

The Cards Have All Been Dealt

Whatever your belief system may be, quantum physicists such as Einstein, Niels Bohr, Werner Heisenberg and a host of others saw the world in entirely deterministic terms.

On some level Einstein surmised, knowing the initial state of a quantum system with absolute precision, as well as all of its relevant forces, would enable calculation of all its future states.

Challenging this view, untold experiments, drawing on the famous theory of John Bell, have proved that quantum measurements possess fundamental, built-in randomness that cannot be avoided — in other words, there’s no way to “beat the house” whenever it comes to guessing quantum outcomes.

Ironically, throwing dice is orders of magnitude more deterministic than the typical quantum measurement — due in large part to the fact that dice are governed by Newton’s mechanistic laws of motion.

Classically, if one can precisely record the position, orientation and initial velocity of a pair of dice thrown in the air and map out the environmental conditions acting on it such as air currents — you could tell before the dice hit the table if a particular roll would produce any combination of outcomes.

And so it is when it comes not just to dice, but other games as well.

Roulette is another game of chance that is also absolutely predictable, given sufficient knowledge of the initial conditions and forces involved. The moment that a roulette wheel is spun and a ball is set into motion along

a track in the opposite direction, the fate of which slot the ball will land in is sealed.

How the ball and wheel begin their trajectories governs their rendezvous with destiny once the former leaves the track, bounces around, and ends up on one of the latter’s numbered spokes — rewarding those gamblers who bet on that

outcome.

In practice though, roulette allows virtually no time to apply a physics degree for successful betting.

Moreover, the very fact that a tiny variation in the initial conditions, such as the speed or trajectory of the ball, can dramatically alter the outcome, making predicting roulette outcomes a daunting task, in a practical sense.

Yet in the late 1940s, that didn’t stop two graduate students from the University of Chicago, Albert Hibbs, a mathematics graduate and Roy Walford, a medical student, from applying the physical laws of the universe to the laws of Nevada — does the house always win?

Hopping on their motorcycles, the Hibbs and Walford made their way to the casinos in Reno and Nevada, where they carefully studied the properties of roulette wheels to look for weaknesses to exploit.

And because this was the late 1940s, the early roulette wheels were far cruder than today’s and especially in the smaller casinos in Reno — had defects.

These flaws, Hibbs and Walford realized offered the key to successful prediction. By studying the mechanical idiosyncrasies of various roulette wheels, they developed predictive models, carefully placed bets and won thousands of dollars — a small fortune at the time and sufficient for them to buy a boat and sail around the world.

And just like those early roulette wheels, the nascent cryptocurrency exchanges are also ripe for gaming — which is why so many of them are gamed by traders.

Because every new cryptocurrency exchange lacks sufficient volume to attract traders, the use of market-making bots is not just necessary, it’s a prerequisite.

But given that there are only so many market-making programs available on the commercial market with which to execute such volume-inflating market moves — therein lies their inherent flaw — one which cryptocurrency traders have been quick to exploit.

Just like the imperfections in early roulette wheels, because there are only a finite number of parameters with which savvy traders have to work with, it is inherently possible to predict with a relatively high degree of precision, the ultimate trajectory of cryptocurrency markets.

Early Games Early Gaming

But as cryptocurrency exchanges become more established they can afford to drop some market making bots and rely on genuine trading activity — which creates a different set of exploits that astute traders can use to gain an edge.

Hibbs and Walford quickly became famous for their exploits at the roulette table and casinos got wise to the flaws in the roulette wheel — ushering in a new era of highly smooth and consistent roulette wheels to return the advantage to the house.

Which is why by the mid-1950s, Edward Thorp, a second-year physics graduate student at the University of California, Los Angeles, decided an entirely different method to try and beat the wheel.

Because roulette wheels no longer had any discernible defects, he thought that perhaps a small computer, worn by someone observing how the wheel was spun and the ball was launched, may be fast and powerful enough to calculate their trajectories and make a prediction.

Thorp put his plan into action. Pretending to be a casual observer, Thorp would transmit the forecast by radio to another player charged with placing the bets. The system worked so well that when Thorp met Claude Shannon, a mathematician from MIT, Shannon immediately went to work constructing roulette wheel models and tiny computers to track them.

By the early 1960s, Thorp and Shannon had built and tested the world’s first wearable computer — the size of a cigarette pack and capable of being fitted into to bottom of a specially-designed shoe.

By the 1970s, it seemed almost as if every self-respecting physicist was attempting their spin of the wheel — when a group of undergraduates from the University of California Santa Cruz, led by astrophysics major J. Doyne Farmer and statistics major Norman Packard upgraded Thorp’s methods, designing an even more compact shoe computer with a state-of-the-art processor.

Using an improved version of Thorp’s computer, Farmer and Packard managed to use their system discretely at casinos with a 44% profit for every dollar bet.

By the mid-1980s, casinos got wise again and upgraded their equipment once more and now banned the use of computers on their gaming floors.

And while the casinos may have foiled the advantage provided by computers — they were not able to stop raw brainpower in the form of the highly successful MIT Blackjack Team that would use their knowledge of mathematics and physics to literally bring down the house in the 1990s — the subject of which became the cult movie “21.”

Cryptocurrency Casinos

Which brings us to the latest digital casino — cryptocurrency exchanges.

To be sure, there are countless flaws on any given cryptocurrency exchange and no shortage of traders looking to exploit those flaws.

For starters, many smaller cryptocurrency exchanges use repetitive market making bots, whose patterns are easy to spot and therefore easy to predict, without the need for, particularly sophisticated tools.

Strategies honed in the capital markets (and since banned) are de riguer — such as front running (putting orders ahead of others) and spoofing (entering and canceling large buy or sell orders to manipulate prices).

Because regulation of cryptocurrency exchanges is on a “where available” basis — much of what occurs on cryptocurrency exchanges, from wash trading (simultaneously selling and buying security) to pump and dump schemes are rife.

But unlike casinos, allowing such behavior, in the long run, is a race to the bottom for what is already a small and highly saturated market.

For the same reason that there aren’t 50 major stock exchanges in the United States, the longevity of cryptocurrency exchanges is not helped by having more exchanges than there are digital assets to trade or traders to trade them.

And allowing such market manipulative behaviors, while attractive to those with an inclination for mathematics, physics and gaining an edge — ultimately pushes out retail traders who may be interested in their first “taste” of cryptocurrencies.

To be sure, at the very least casinos work on odds which give the house only a slight advantage — meaning that over the very long run the casino will always win — but that still means that almost 4 in 10 gamblers will walk away winners as well — just maybe not on every visit.

Not so with cryptocurrency exchanges.

Failure to weed out manipulative market behavior means that unsophisticated traders will constantly be left holding the bag.

There’s a saying in market circles,

“If you don’t know who’s being played, it’s probably you.”

And while mathematicians, statisticians, and physicists have been using the cryptocurrency markets as their hobby ground to make a quick buck — perhaps in the long run, the ability to do so unabated may kill the goose that lays the golden eggs.

To that end, cryptocurrency exchanges ought to do more to level the playing field and some have already. But short of regulatory oversight, there is little to compel cryptocurrency exchanges from preventing savvy traders from fleecing the less sophisticated.

And perhaps that’s because the sophisticated traders are gambling that it won’t be their bet that will bring down the house, that they still have time — but that’s probably the biggest gamble of all.

Written by Patrick Tan on Medium for Altcoin Magazine

Patrick Tan is CEO of Novum Global Technologies, a cryptocurrency quantitative trading firm. Trading up to 100,000 times a day the way only an algorithm could.