-

Beijing is prepared to make concessions on the disclosure of Chinese audit information in an effort to clear the impasse that could threaten the continued listings of over US$2 trillion of shares in U.S.-listed Chinese companies.

-

While ostensibly, Beijing has been wary of permitting foreign regulators to dive into company accounts and documents, alleging risks such as providing access to sensitive intellectual property, the bigger concern is probably under the umbrella of “national security.”

Which may explain why Beijing is prepared to make concessions on the disclosure of Chinese audit information in an effort to clear the impasse that could threaten the continued listings of over US$2 trillion of shares in U.S.-listed Chinese companies.

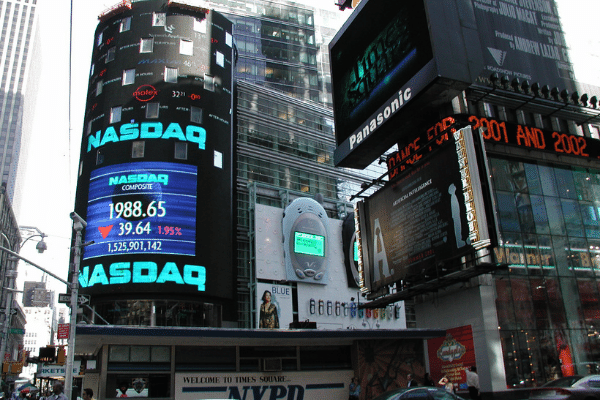

A week after the U.S. Securities and Exchange Commission threatened to delist some Chinese companies from U.S. exchanges, Beijing plans to provide some audit information to U.S. accounting regulators.

While ostensibly, Beijing has been wary of permitting foreign regulators to dive into company accounts and documents, alleging risks such as providing access to sensitive intellectual property, the bigger concern is probably under the umbrella of “national security.”

Diving into the inner workings of many state-owned Chinese companies listed on U.S. exchanges and even those that are privately held, could throw up transactions and ties which may prove publicly inconvenient for many high-level Chinese officials.

As such, Beijing is proposing a pragmatic system which will require companies to check back with authorities before making financial audit information available to foreign regulators, which will provide a possible path forward and the first time China will disclose financial information of its companies outside of its borders.

Beijing has long been cagey with its companies, even if they are listed overseas, prohibiting access to files and other documents for audit purposes, but which also clashes with the Trump-era U.S. Holding Foreign Companies Accountable Act, passed in 2020 requiring the U.S. public Accounting Company Accounting Oversight Board to examine audits of Chinese and Hong Kong companies.

Last week, the SEC threw down an ultimatum for five Chinese companies to comply with audit requests within the next three years or face ejection from New York exchanges.

But it remains to be seen if Washington will accept Beijing’s counter proposal to submit its companies to audit, with “Chinese characteristics” as to the nature of such audits.

With the Chinese economy facing major headwinds, soaring commodity and energy costs hitting consumers and ill-conceived pandemic lockdowns dampening sentiment, the last thing China needs is a wave of delistings cutting its companies off access to foreign capital markets and global investors.

China’s Vice Premier, Liu He, and also the country’s top economic official, reassured investors this week that Beijing would take measures to support the economy and financial markets after a sharp selloff in Chinese equities was exacerbated by Russia’s invasion of Ukraine.

Beijing’s dogged resistance of condemning the Russian invasion and Chinese President Xi Jinping’s apparent doubling down on his close friendship with Russian President Vladimir Putin is also weighing on sentiment and appetite for Chinese shares.