This week, Binance kingpin CZ capitulated to US authorities.

He and his exchange, Binance, will pay over $4 billion to the US government for facilitating money laundering and sanctions evasion. CZ may go to jail.

Binance will continue operating under the US government’s watch. No collapse. No implosion. All funds are SAFU!

Time will tell what this means for crypto prices. One step closer to Wall Street’s dream scenario: “safe, regulated” crypto that they can sell to mainstream investors (for a small fee).

For us, we know better than to worry. When crypto businesses die, the protocols survive. We buy into the protocols, not the businesses.

In any event, Binance didn’t die. The Feds said “if you change the CEO’s picture on your website, pay us $4 billion, and let us see your books, we’ll make this all go away.” CZ said “ok.”

Naysayers say this is bad for crypto. They didn’t get the memo.

Bitcoin secures $700 billion worth of wealth without a single soldier, missile, warship, regulator, treasury minister, or Federal Reserve chairman. Now, it will secure that wealth without CZ, too. Nothing else changes.

Maybe Binance will survive, maybe it won’t. As long as you hold your crypto in your own custody, you have nothing to fear.

No haters

No such luck for those of us who depend on government money.

We need the soldiers, missiles, warships, regulators, ministers, and central banks. We need the coercive power of the state. Otherwise, our money is worthless.

We have no social network or protocol to back our money, only the utility that comes with an artificial, government-imposed monopoly on monetary policy.

That’s not a knock on the system itself. The system does wonderful things for many people. Governments should have their own money. The system is flawed, but it works. That’s more than you can say for most cryptocurrencies.

Contrary to popular belief, I don’t hate central banks or fiat currency. They’re useful.

I actually like Jay Powell and appreciate the way he presents himself. I respect the job that he does. “Don’t fight the Fed” is a mantra for a reason!

I’ll bet when all is said and done, he’ll be remembered as a pretty good Federal Reserve chairman.

The problem is, being Fed chairman is like being the referee at a gladiator contest. If you do your job well, somebody dies. The game always results in tragedy.

By design.

When the economy does poorly, you pump the assets of rich people and make it cheaper for them to borrow against those assets.

When the economy does well, you crush wages, squeeze profits, and give free money to people who already have cash (i.e., rich people).

Those are the rules of the game.

Why you’re here

You probably came into crypto to escape that game. You know those rules always work against you. With a little luck and some smart decisions, you might win financial freedom with crypto.

That’s certainly realistic—if you’re patient. Either prices need to go up a lot more or the technology has to reach a higher level of adoption and utility. Preferably, both.

Until then, you have to stick to the system your financial authorities want you to use. Play the game.

You already pay for soldiers, missiles, warships, regulators, treasury ministers, and Federal Reserve chairmen. You might as well get something out of it!

Don’t feel bad. If you play that game well enough, you can earn financial freedom that way, too. No crypto necessary. Just do what they tell you to do and you’ll get what they want you to get.

Good luck keeping it! Your government will try to make it worth at least 2% less each year and put all sorts of limits on what you can do with your “freedom.”

With crypto, you get an opportunity to find an alternative that fits you better.

How do you make the most of this opportunity?

My plan

Lots of people have great strategies for the crypto market. I have one, too. My plan.

My plan will get you better results than most traders and everybody who follows the traditional “dollar cost averaging” approach. No trading, timing the market, or following the news.

In 2023, Bitcoin’s average price is $27,500.

With my plan, your average price is $25,300 over that same period. That’s 9% more bitcoin for your money.

From my plan’s inception, your average buying price is $23,400, compared to an average price of $29,950 for dollar cost averaging. If you followed the plan over that time, you did almost 30% better than dollar cost averagers with plenty of opportunities to take profits along the way (I did not).

Today, you’re up as much as 600% or down as much as 25% at the extremes. Most likely, you’re up 60% with cash to spare.

Today, my plan says not to buy. Tomorrow, who knows? Opportunities come all the time.

What about altcoins?

Will my plan will help you with altcoins?

No. My plan is specific to bitcoin. Bitcoin is the king. Wherever bitcoin goes, the rest of the market follows.

Generally, when bitcoin’s price is low, altcoins are a good buy. You should feel comfortable buying altcoins when bitcoin’s price is in the buying zone of my plan.

Take profits at your own peril

With the market rising, you’re probably up 100% or more on some altcoins. If you bought altcoins every two weeks from June 2022 to April 2023, like I did, you have a few that did even better.

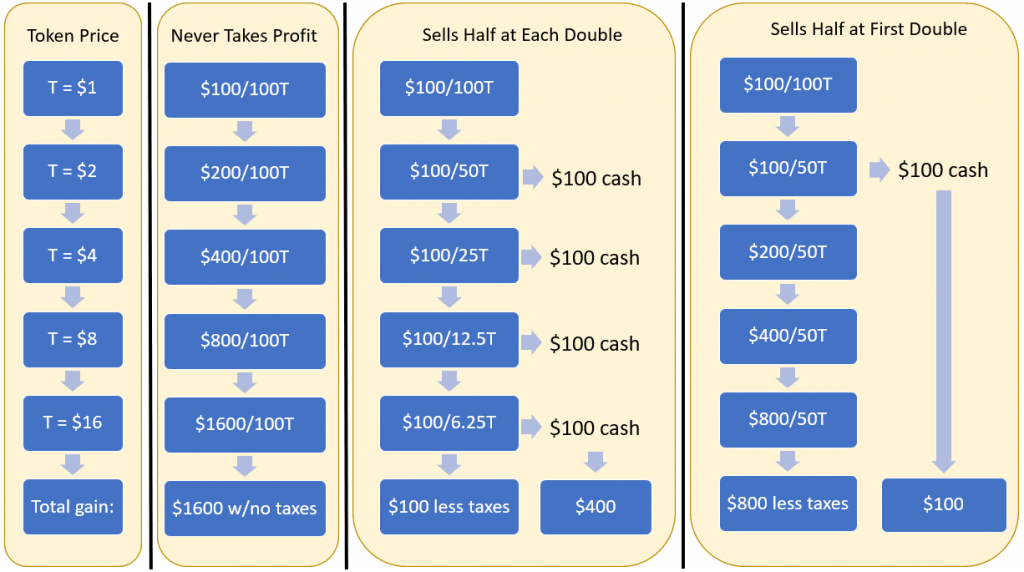

Conventional wisdom says you need to sell half of each winner now and take the “free ride” with your remaining tokens.

Conventional wisdom is fine for conventional markets. With crypto, you’re playing for 100x gains. That’s hard enough when your timing is perfect. When you sell after the first 2x, you make it twice as hard.

You also have to pay taxes on your gains. As a result, you’ll need to sell more than half—up to 75% in some jurisdictions—or find money from somewhere else. That’s on top of the future gains you’ll lose from growth you’ll miss out on.

When you take profits, there’s a good chance you’re taking profits from your future self!

If you want to double your money quickly, go to a casino. Gamble with your government’s money, not assets that can grow 100x or more in the coming years.

Mark, are you saying we should never sell?

No.

If we ever get another altseason, some of these altcoins will get crazy expensive, way beyond any reasonable valuation. You can sell then.

(For example, SAND, MANA, ENJ, and other metaverse tokens jumped the shark in 2021. They may never go that high ever again even if they’re wildly successful.)

Others will die. You can sell your losers for the tax deduction or cash them in for a profit during altseason, if we ever get another one.

(Yes, dead altcoins can pump very high during altseason—or any season for that matter.)

Preserve capital? Not with altcoins!

I get it. You’re skeptical. Everybody says to take profits. Sell after your first double. Sell at levels of resistance. Sell at fixed intervals or prices. Set a stop-loss.

Why? To preserve your capital?

If you’re trying to preserve your capital, don’t buy altcoins.

These are volatile, speculative assets. The only justification for altcoins is the 100x potential. Selling for less defeats the purpose. Learn how to play poker or blackjack instead.

Or, stick with bitcoin and follow my plan. It’s a guaranteed 2x without taking profits. Some think you can squeeze a 4x out of bitcoin over the next year or two.

Altcoins might not do that for you. Even if they do, bitcoin might get there sooner. Bitcoin outpaces most altcoins over any random timeframe and beats almost every altcoin (including Ethereum) from peak to peak.

You’re not going to find a better risk-to-reward investment than bitcoin at today’s price in these circumstances.

(Except more bitcoin at lower prices without a substantive change in circumstances.)

Buy altcoins to own an outsized stake in the financial networks of the future for a fraction of its future cost.

Think of it like swinging for the fences. You’ll smash more home runs and strike out a lot. Those home runs will more than make up for the strikeouts and go a lot further than a few slap singles into left field. See for yourself:

Liberty, not freedom

Some say you can’t get financial freedom with bitcoin. There’s just not enough upside.

Are you sure? 35% CAGR is pretty, pretty good for a low-risk asset.

Bitcoin is the only asset you can send to anybody, anywhere, anytime, in any amount, instantly, with certainty the payment will go through, without needing to collect or share any personal data, and without the risk of receiving fraudulent tokens.

It works without a development team, foundation, or treasury. It outpaces 80% of the top 100 altcoins each year. It’s outpaced Ethereum for six and a half years.

Nobody’s ever hacked it. All its forks fail. It’s robust, resilient, and battle-tested.

While you stress about financial freedom, don’t forget financial liberty—the right to choose what type of money you use, how you secure your wealth, and what type of assets you can trade for the things that you want. The ability to act according to your conscience, not your government’s decrees.

Let’s say you “win” crypto. All of your altcoins do 100x. You sell each of them at the exact peak. You cash out at maximum gains.

Wealth beyond your wildest dreams.

That wealth will forever be priced in your government’s money and exchanged for only whatever your government allows, on whatever terms it dictates.

The value of everything you own will always depend on your government’s monetary decisions.

No matter how much you have, you are never truly free. You remain a servant to an entity that can change the laws or rules at any time. You are forever burdened and constrained by authorities who can freeze, steal, or arbitrarily destroy the value of everything you own.

When your government has monopoly control over your money, you don’t have a choice.

With cryptocurrency, you do. You get to choose what rules you play by.

Pro-choice

When you don’t like one system, you can choose another.

When you don’t like one protocol, you can choose another.

You will never have to worry about what your government does with its money. Pay your taxes with your government’s money and manage the rest of your affairs with whatever currency makes the most sense.

Secure your wealth on immutable networks that transcend space, time, and jurisdiction. Force your government’s money to earn your loyalty.

With the legacy financial system, you have no liberty. You have to go along with what they want. “Don’t fight the Fed,” as they say.

You will never choose who governs your finances or how to exercise your best judgment. You can’t make and spend money according to what your conscience deems fair and valid. You won’t derive your wealth from a system that matches your beliefs and principles.

Once crypto prices go high enough, you will trade your stake in the financial networks of the future for more of your government’s money. You’ll put yourself back into the rat race. You’ll sacrifice liberty for security and end up with neither, just more of your government’s money and the never-ending stress of how to get more of it.

When you sell your crypto, you swap the experience of freedom for the appearance of it. You give up any chance of escaping the game.

Make sure it’s worth it.

Give me liberty or . . .

Did you read Robert Kiyosaki’s book, Rich Dad, Poor Dad?

It’s a parable that teaches a lesson about how to use your time, talent, and money to make more money.

On one level, the book extols the virtue of using passive income and cash flow to buy assets and property that generate more passive income and cash flow.

In other words, how to win your government’s game.

On a deeper level, the book reveals a raw truth: if you play that game well, your government will reward you. If you don’t, they will screw you over.

Poor dad followed his principles. He worked a safe job, borrowed to pay for his needs, and spent what he earned. He never used other people’s money to make his own.

Rich dad played the government’s game. He bought assets, borrowed against those assets to buy more assets, and banked the cash those investments threw off. He always used other people’s money to make his own.

Poor dad had no assets for the Fed to pump when the economy went down and no cash for the Fed to pump when the economy went up.

Rich dad won no matter what the Fed did.

. . . an escape

What if poor dad had an escape? A financial system that gave him a leg up?

With cryptocurrency, we can experiment with all types of rules and monetary principles. It’s a Lego kit for finance and economics.

We can replace our government’s money with immutable protocols that work without human intervention. Open networks that draw resiliency and legitimacy from strong communities, not coercive power.

A chance for poor dad to win.

These are experiments, for sure. We’re replacing economists and central banks with entrepreneurs and engineers. We’re replacing politicians with computer code. A lot can go wrong.

We risk our financial fortunes on the outcomes of these financial experiments. When we win, we gain far more than anything we could get with our government’s money.

Economists and central banks can tell us how wrong we are. There are millions of poor dads (and moms) who have suffered for so long under systems created by those same economists and central bankers, that they’ve stopped caring about what those economists and central bankers say.

They want an alternative.

The rich are never free

Rich dad’s wealth will only last as long as the authorities let it last. He always has to stay one step ahead of those authorities, angling for loopholes and paying people to figure out how he can use the rules to get ahead.

Those rules are arbitrary. They are imposed by some authority. If he’s lucky, powerful enough, or well-connected, he can change those rules—until somebody else changes them back.

Rich dad may think he has financial freedom, but in truth, he only has more of his government’s money and “things” that his government lets him use to make more of his government’s money.

You may or may not have a lot of your government’s money. Fortunately, you have a solid allocation to crypto, so you have a chance at financial liberty. You can expect to see the value of your crypto rise quite a bit in the coming years.

Selling now makes sense if you need more of your government’s money and worry you can’t get it anywhere else. It’s a temporary reprieve from a larger problem: you can’t afford to live the life that you want—and the legacy financial system doesn’t help you do that.

Not what you want to hear

When we reach the peak of the market or one of your altcoins goes up 100x, or somebody flashes a chart that looks good, you won’t think about any of the things I just talked about.

You will think about what you can do with all the government money you can get from selling your cryptocurrency. You’ll see the price of your cryptocurrency in your local currency and feel compelled to sell.

Maybe you’re already thinking about that now. Maybe you picked out a target or some formula for taking money out of the market.

Good. Your first priority: taking care of yourself, your family, and the people you care about. You can’t eat a bitcoin!

How do you quantify that priority? If you had to put a price on it, what would that price be? Are you sure you can only get that from crypto? Is it worth giving up your financial liberty? Is it worth giving up your stake in the financial networks of the future?

Think about why you read or listen to this newsletter instead of spending more time with friends and family. Why aren’t you shopping, playing video games, running errands, or taking leadership and management courses? Why do you put this effort into crypto instead of your business, trade, or household?

You’ve given up time, effort, and money to read and listen to the things I post. I appreciate it! You have no idea how humbled and happy it makes me feel. Some of you also paid me for portfolio reviews and consulting. You probably do this with other content creators, too.

Why?

Know now, before it matters

Answer these questions now so you know what you want to get out of this market.

Maybe financial freedom isn’t that important. Maybe you want something more, or simply something else.

Maybe you feel comfortable with whatever your government is doing and you see crypto as a way to get ahead. Maybe you have a different idea in mind.

If 2022 was the last best time to get into crypto, 2023 is the last best time to get the mental clarity you need to navigate this market. Figure out your honest goal now, before that altcoin does 100x or bitcoin’s price reaches $150,000 or whatever other visions the bull market champions have put into your head.

You’re sacrificing business opportunities, professional growth opportunities, and opportunities to generate cash flow and passive income.

Obviously, there is something about cryptocurrency that’s more compelling than anything your government’s money can do for you. What is that?

Find it now.

For me, financial freedom is not possible. I have a wife and kids and need to set aside money in case we need to care for parents and loved ones.

I’ve already gone over the numbers with my financial advisor. There is no amount of money that I can put into the crypto market that could ever deliver financial freedom.

Once the kids grow up, that might change. We’re a long way from that!

So financial freedom is off the table. It’s ok! I’ll be happy with long-term wealth and financial security.

While the Fed tries its best to hold down wages and make it harder for businesses to make money, you try to do the opposite.

It’s a struggle that few ever win—to the point that most investors give up.

“Don’t fight the Fed,” as they say.

With cryptocurrency, you don’t have to fight the Fed. Instead, you can peacefully, quietly choose an alternative. You can play a new game. You can assert your financial liberty.

That’s something no amount of money can buy.

Relax and enjoy the ride!