- Singapore Exchange (SGX) is said to be attracting more listings in coming months by Chinese issuers that already trade American depository receipts, even as it grapples with delayed deals amid a global valuation slump.

- According to data compiled by Bloomberg, there are at least 11 China-domiciled firms that have listings in both the U.S. and Singapore, a number that could grow and provide a boost for SGX, which is itself listed.

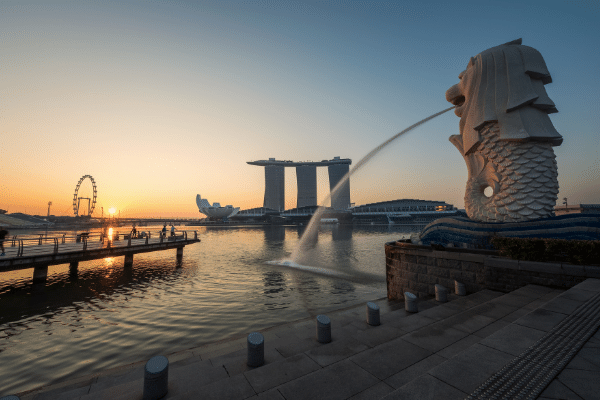

When former U.S. President Donald Trump was to meet with North Korea’s leader Kim Jong Un, many possible locations were mooted before Singapore (humidity notwithstanding) was finally secured as the place for the two nuclear powers to have their leaders meet.

For decades, the tiny city state, one of the richest places on the planet, has played host to juggernauts and provided refuge to the persecuted, provided of course that they are “sufficient.”

So, when Chinese firms facing greater regulatory scrutiny, especially with respect to their financial data, came under threat of delisting from U.S. bourses, there were only really a handful of alternative trading floors to head to, Hong Kong, Shanghai and of course, Singapore.

Listing in Hong Kong proved nowhere near as expedient or as straightforward as many U.S.-listed Chinese firms had anticipated, while many are already listed on both Shanghai and Shenzhen stock exchanges, which is where Singapore came in as the obvious choice.

Singapore Exchange (SGX) is said to be attracting more listings in coming months by Chinese issuers that already trade American depository receipts, even as it grapples with delayed deals amid a global valuation slump.

If the first clutch of listings in Singapore is successful, investors can expect others will follow suit after electric vehicle maker Nio Inc.’s technical listing in May.

SGX is also in talks with companies in China and Southeast Asia operating in areas such as fintech and consumer tech that it would like to attract to its bourse.

The Singapore bourse is also looking to attract other companies listed in the U.S. but declined to speculate on potential homecoming listings, including Grab Holdings and Sea Ltd, two tech juggernauts that are headquartered in Singapore but listed on Wall Street.

While the draw for Chinese firms listed in the U.S. to relist on SGX is one born out of necessity, the same considerations may not necessarily apply for Singapore-headquartered firms to return home, especially as they continue to have access to the far more liquid and deep capital markets of the United States.

Listing plans globally this year have waned with investors deterred by high inflation and rising interest rates and many companies have had to delay offerings for on SGX, including big-ticket names such as Thai Beverage and Olam Group.

Last month SGX inked an accord with the New York Stock Exchange that allows for better collaboration on dual listings of companies, a move that could help facilitate some companies Chinese companies listed in the U.S. moving to the somewhat more hospitable market.

According to data compiled by Bloomberg, there are at least 11 China-domiciled firms that have listings in both the U.S. and Singapore, a number that could grow and provide a boost for SGX, which is itself listed.