- Yesterday, a senior Fed official called for rate hikes to a level which stunt economic growth by the end of the year, unperturbed by what that would do to the labor market.

- Investors therefore should keep a keen eye on Friday’s U.S. labor report, which has routinely outperformed economist estimates and could embolden hawks on the Fed.

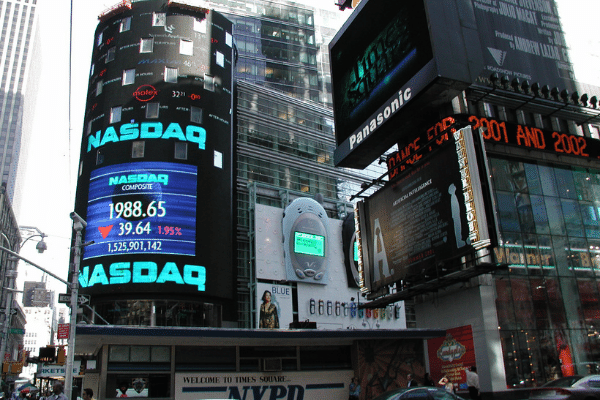

Given the persistently high rate of inflation in the U.S., the U.S. Federal Reserve weighed in with its highest rate hike since 1994, a whopping 0.75% increase in borrowing costs, and above its guidance provided earlier of a 50-basis-point raise.

Last week’s Consumer Price Index data defeated economist expectations of a yearly inflation rate of 8.3%, coming in at a hot 8.6% and rolling back suggestions that the pace of price increases was slowing.

To be sure, there has been little to suggest that prices are moderating, especially for food and fuel.

If nothing else, Russia’s continued and dogged determination to wrestle a victory in Ukraine will delay crucial supplies of fertilizers, agricultural commodities and energy from re-entering the global market at a time when decades of loose policy have left far too much liquidity in the financial system.

On Wednesday, the Fed lifted the target range for the Federal Funds Rate to 1.5% to 1.75%, up from 1% to 1.25% previously and with more analysts suggesting the year could end with rates being closer to 3.4% and as high as 3.8% by the end of 2023 from 1.9% to 2.8% the Fed had penciled into their March projections.

Nevertheless, markets rallied on remarks from U.S. Federal Reserve Chairman Jerome Powell’s post meeting comments, where he noted supersized rate hikes were unlikely in the future,

“Clearly, today’s 75 basis-point increase is an unusually large one and I do not expect moves of this size to be common.”

But investors may simply be looking for any reprieve in a year that has delivered only bloodshed and a flexibly hawkish Fed is a low bar to land at for risk assets.

Whether or not the rally will prove durable is less certain, especially since inflation expectations remain elevated and are likely to stay that way for some time, while policymakers appear determined to bring price pressures closer to target 2%.

Confounding matters for market bulls, the Fed reiterated that it would shrink its massive balance sheet by US$47.5 billion a month, a move that started at the beginning of this month and which will gain pace to US$95 billion a month by September.

Markets haven’t yet fully priced in the effect of this reversal of years of quantitative easing, how it will affect yields, and the impact on risk assets.

The risk of recession has been raised even further, despite Powell dismissing the suggestion that the central bank was trying to induce one, noting that he saw “no sign” of a broader slowdown while assuring Americans that higher rates could be borne.

Despite the central bank rhetoric, there are plenty of reasons for concern.

Credit card debt has increased in March and April at a pace faster than before the pandemic and much of that spending has gone into purchasing necessities.

More Americans are living paycheck to paycheck and ample savings are now starting to be whittled down.