Bitcoin Price Remains Highly Volatile

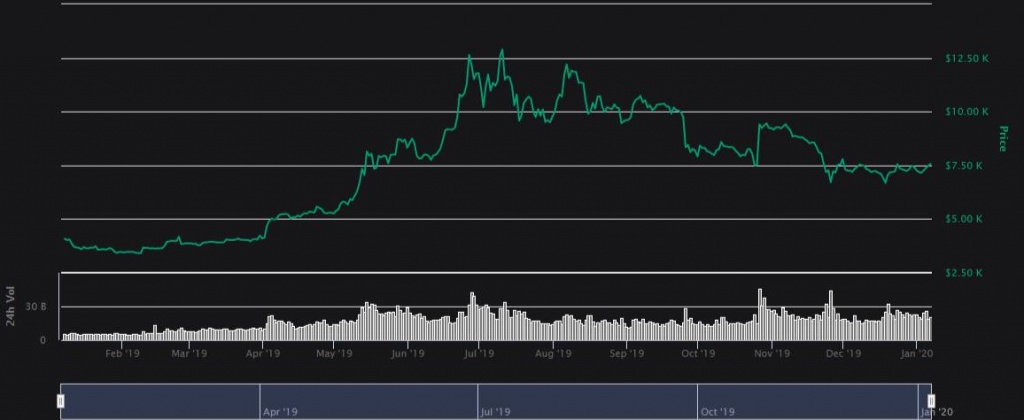

People tend to be surprised when they have learned the fact that Bitcoin was the best performing asset in 2019. Despite a crazy run which was shortly followed by a blow-off top at $14,000 level and entered a down trend for the latter part of the year, Bitcoin has accumulated a yearly gain of 87% according to Coinbase’s price. Meanwhile in the traditional market, the S&P500 ended the year with 30% gains while gold being traded over $1,500 bringing its 2019’s gain to more than 18%.

Bitcoin kicked off the year with the price of $3,826 before marking its yearly low at the beginning of February with the price of $3,340. The price spiked up sharply after April’s 1st, leaving everyone in confusion that if it was an April fool’s joke and to be considered as a black-swan event. The price continued to make it way upward with Facebook’s Libra hype fueled the buying. However, the frenzy has ended in the 3rd quarter marking the yearly high of $13,868 and the market has entered a down trend ever since. On December 31st, after being traded in a sideway price actions for the past month with some swing lows at around $6,400 level, Bitcoin finally finished 2019 with the year-end price of $7,165.

Source: coinmarketcap.com

Miners Still Find Profit whilst Hash rate & Difficulty Level Surges

Bitcoin network has grown even more secure over the year of 2019. Hash rate in simple terms is the speed at which computers on the network operate. For miners, the higher the better, as it increases the chances of completing the mathematical problem to solve the block and collect the resultant block reward. We have witnessed the Bitcoin’s hash rate breaking its all-time-high on the monthly basis and reaching 100EH/s at year’s end, while during Bitcoin’s price peak in mid-December 2017 the hash rate was only around 15EH/s. This means more miners has joined the network and more powerful ASIC mining devices have been equipped. However, the network is constantly adjusting itself by increasing the difficulty rate to ensure that new blocks cannot be created too fast, leaving vulnerability for 51% attack or block re-org.

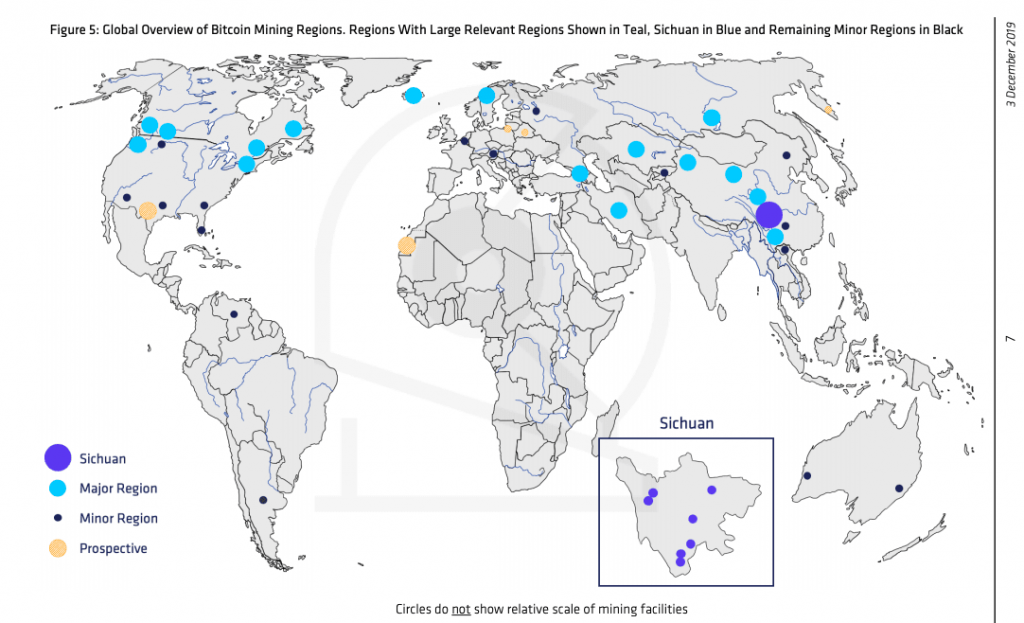

It has been roughly estimated that the cost to mine one Bitcoin in China is around $3,000 while the rest of the world is ranging around $6ks. China also took the lead in utilizing renewable and surplus energy to mine Bitcoin, which contribute to a much lower cost in mining. Sichuan alone, with 90% renewable energy penetration, controls over 50% of global mining processing power.

Source: CoinShare Research

Bitcoin Transaction Volume Trumps Paypal and to Exceed Internet in 2020

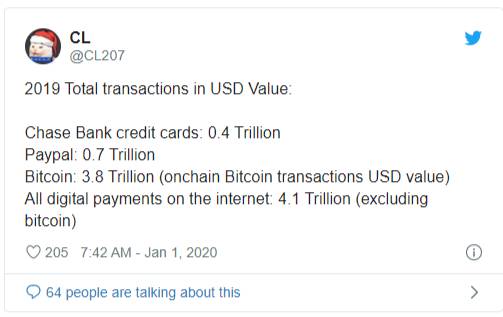

According to the on-chain transaction of Bitcoin in USD value, it has reached a whopping $3.8 Trillion in 2019. The popular over-the-internet payment system PayPal clocked in at $0.7 Trillion, while all digital payment on the entire internet was at $4.1 Trillion according to statistic portal Statista. It is worth mentioning that the research might have not included the data from China since it is estimated to be over $40 Trillion worth of digital payment being transacted by Chinese mobile payment in 2019.

Source: Twitter @CL027

This is a clear evidence that the Bitcoin network is pretty much alive and being used heavily on the daily basis. Moreover, on September 2019, someone has made the biggest transaction in USD volume via Bitcoin in history, the entity has moved over

$1 Billion at then-current Bitcoin price or 94,500BTC in a single transaction.

Lightning Network – the Potential Bitcoin Scaling Problem’s Savior

2019 was also a great year for Lighting Network, a second layer payment protocol to solve the Bitcoin’s scaling problem. It has seen healthy growth, wallet development, and adoption from the exchanges. The number of nodes doubled from 2,400 nodes to 4,900 nodes at year’s end, while the network capacity jumped from 550BTC to the ATH of over 1,000BTC in May and 850BTC at the end of December.

More user friendly wallets have been rolling out in 2019, both in custodial like Blue Wallet and non-custodial type such as Zap and Phoenix, granting users the ability to choose one that best fit their needs.

Cryptocurrency exchanges were also beginning to test Lightning Network in an attempt to have a competitive edge over another. Bitfinex was one of the first major player to offer LN support, allowing its user to withdraw and deposit their Bitcoins on the exchange almost instantly. Some of the P2P exchanges like HodlHodl and Local Lightning also showed their support of the LN. The wide adoption on Lightning Network could bring Bitcoin back to become a viable payment option once again.

Looming Institutions Players

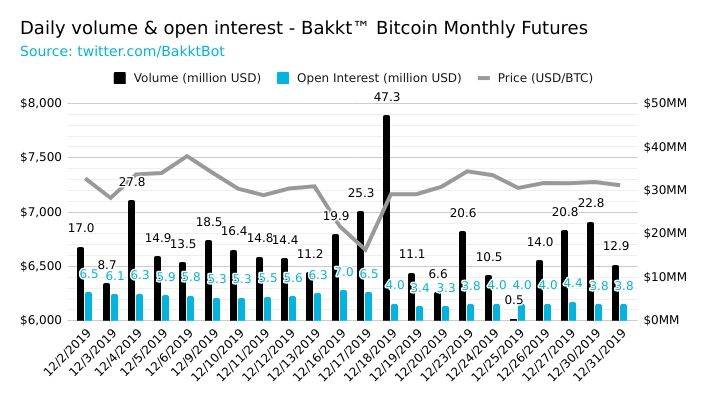

We have multiple major news regarding the long-awaited institutional players throughout the year. One of the largest news last year was that Bakkt, the physically settled Bitcoin future trading service owned by the Intercontinental Exchange (parent company of NYSE) was finally launched. The trading volume of Bakkt has been starting off slowly but eventually gained more traction with the 24hrs volume record high at $47.3 million. Bakkt also announced that it is planning to launch an application which allows its users to directly spend their digital assets to purchase goods and services from merchants.

Source: Twitter @bakktbot

There are multiple news and rumors of the world’s major powers like the Chinese government and the European Union are looking deeply into the Blockchain technology and considering the development of their own digital currencies. China’s President Xi Jinping has directly stated that China should “adopt Blockchain technology and take a leading position in this emerging field.” Followed by an announcement of the DCEP (Digital Currency Electronic Payment) suggesting its way toward a national currency building on top of Blockchain and Cryptographic technologies.

On the horizon

The Bitcoin and Cryptocurrency space as a whole has come a long way this year. We were seeing volatile price actions as well as many technological developments behind the scenes. With institution players at door’s step and the Bitcoin block reward’s halving less than half a year away, there are certainly plenty of opportunity for both traders and investors to harvest. The future is looking bright as the space become more mature over time and it will generously reward the people who have the patience or smart enough to get in early.