- Bets on higher inflation are waning against a backdrop of dour economic data.

- More than an outside chance that U.S. Federal Reserve may pause rate hikes as soon as September, meaning smaller increases like 25-basis-points as opposed to the larger hikes that the market has continued to brace itself against.

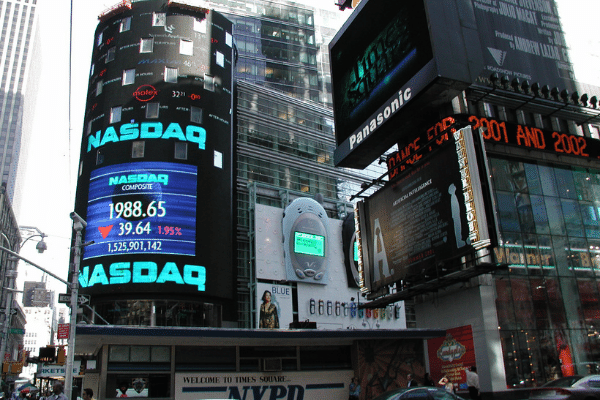

With inflation bets on Wall Street coming down from their record highs, the U.S. Federal Reserve may be able to claim a provisional victory as economic indicators suggest that the much-feared commodities supercycle was not to be.

Bond-acquired expectations for price growth over the next few years are declining, together with the reversal of a breakout from value stocks and easing of commodity prices.

There are signs that this year’s once-profitable inflation trade has peaked, creating an environment which threatens cross-asset trading.

The Fed’s policy tightening is beginning to yield tangible easing of price pressures, which should help businesses plan their next phase with a higher degree of certainty.

Speaking with Bloomberg, Chief Global Strategist at Principal Global Investors Seema Shah suggests that “US inflation is likely close to peaking,” adding that consumers are shifting away from consumer goods and consuming more services amidst a slowdown in overall demand, hence “core goods price pressures are becoming more deflationary”.

Since March, a slew of commodities has tanked to their lowest levels in months, and US$1.9 billion Invesco DB Agriculture exchange-traded fund is facing its largest cash withdrawal since 2008, with US$235 million pulled from the fund.

There are growing signs that the U.S. economy may already be in a recession, with GDP growth over the past quarter likely to come in at zero and a more than outside chance the inflation print for June will come in lower than the white-hot CPI of 8.6% in May.

If inflation indeed moderates, then any further tightening in July may not necessarily usher in a fresh correction in risk assets, because it’s likely that this quarter will see the U.S. economy actually shrink and indeed, it’s entirely possible for the Fed to “pause” rate hikes in September.

But pausing rate hikes isn’t necessarily cutting interest rates, merely slowing the pace of increases and that has implications for all manner of risk assets on the upside.