2019, The Year of Security Token Offerings (STO) — I’m sure we have seen this headline everywhere since 2018, during the decline of ICOs. Surely there has to be a catalyst to reinvigorate the ICO markets they said. We started to see STO issuance platform mushroom, with Polymath and Securitize. So where are all the STOs today?

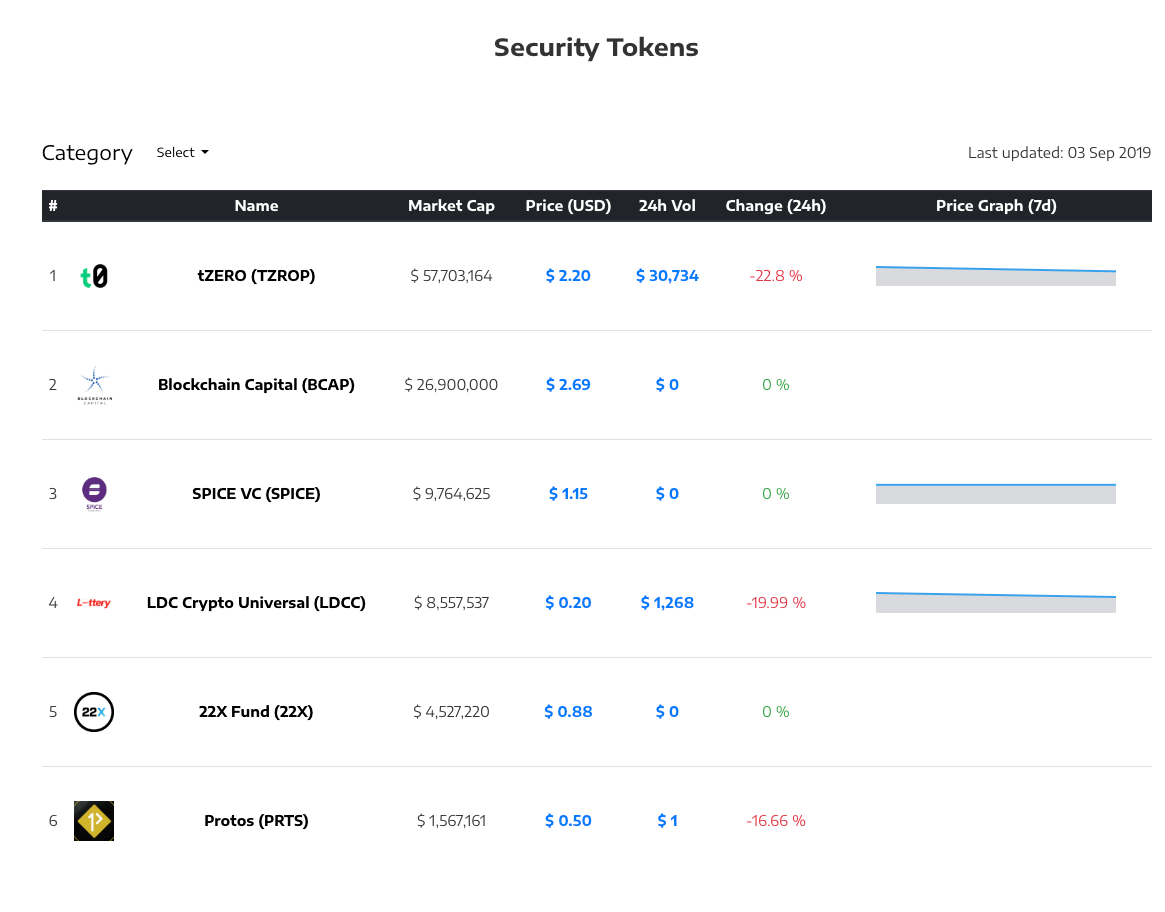

A quick search shows that security tokens can soon join the ranks of dead coins. Most exchanges seem to be in perpetual launching mode with no hard dates of their launch, while some like LATOKEN has pivoted beyond recognition to your vanilla crypto exchange avoiding any mention of securities like a plague.

No doubt blockchain technology powered securities can be beneficial, but are these institutional grade investments not attractive enough? STOs looks like a business textbook case of market product misfit, whereby the product is not what its targeted audience needs.

Not Crypto To Go Around

The top 1% of Bitcoiners owns more than 86.3% of Bitcoin market cap but where the majority still fall within the 1–10 BTC band, able to afford a small portfolio of securities for sure, considering the top 50% Americans who own stocks hold over $132,000 worth of stocks.

But in the crypto space, this target crowd is way too small, considering only an estimated 85,800 people (0.65% of Bitcoiners) own > 10 BTC ($105,200 as of this writing).

Same Same But Different

STOs are virtually identical to securities, they are regulated under the same regulations, with the only exception that they are traded on different exchanges, possibly different currency pairs.

The argument was that with STOs taking off, STOs would be the old money’s first step in the crypto foray. The truth can’t be further away with traditional investors, they don’t look at blockchain benefits, they are no-coiners after all. They take one look at the overall (non-existent) STO market and volume. ICOs and other crypto assets still look more attractive with their returns and liquidity, perfect for divesting into non-traditional assets if they were looking to.

Traditional investors wouldn’t benefit from fractionalization at all too, they don’t need the minimum buy-in of a fund to be lowered to $1,000, it’s not something they would even spend their time researching on.

STOs were to cater to Bitcoiners who were looking at institutional approved assets, benefiting from fractionalization, able to buy into assets they wouldn’t have otherwise. But with the extreme disparity in Bitcoin wealth, the majority of Bitcoiners would already have access to traditional assets.

Market Awkwardness

The crowd that STOs were created for unfortunately and ironically would not be able to access STOs as per how securities were designed to be. STOs only can accept investments from accreditated investors, them having >$1M in assets or an annual income of $200,000. STOs are indeed in an awkward market position when compared to other investment products.

Majority of STOs today still lack applications and real demand. People still trust the law over blockchain technology. Most STOs do not have a real pressing need to tokenize their securities. Tokenized funds or property doesn’t need to have lightning speed settlements. Blockchain technology could help ease investor administration work but we haven’t got to that inflection point yet for most use cases.

In Closing

STOs are a product which value proposition simply is not what either of its intended audience needs, or can have access to. Possibly when we see an established, still private company deciding to do an STO instead of an IPO. It could become a rich man’s novelty bet into owning the next BRK-A, but we won’t see a flippening any time soon.