The Bank of Thailand (BoT) and the Hong Kong Money Authority (HKMA) have collaborated in researching central bank digital currencies (CBDC). They also planned to release a cryptocurrency research report in the first quarter of 2020, reported EJ Insight.

Both banks started their collaboration in May 2019. The BoT’s CBDC is named “Inthanon,” and HKMA’s CBDC is “LionRock.” The banks are reportedly working on the transaction trial period of “payment-versus-payment” (PvP) between banks in Hong Kong and Thailand using both CBDC.

Edmond Lau, an executive at HKMA, said the central bank is focusing on bringing the CBDC to be tested for PvP, not for general transactions.

BoT and HKMA join hands to develop blockchain

SuperCryptoNews reported on August 19 that the Bank of Thailand (BOT) was working with the Hong Kong Monetary Authority (HKMA) to develop a blockchain system for international money transfers. The collaboration was part of the third phase of the “Inthanon” project.

The initiative has already been completed and tested in two stages. In the first phase, the project was developed in collaboration with R3 and Wipro. The second phase was completed in July.

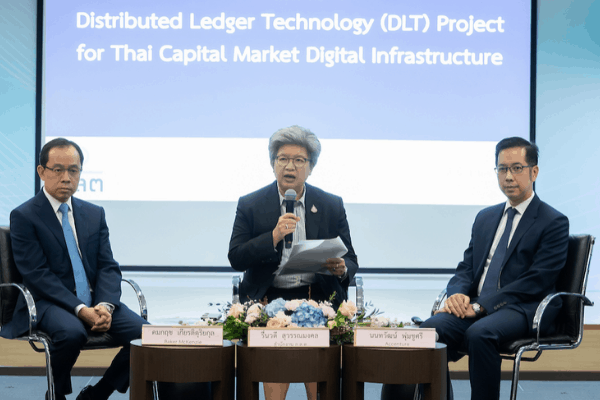

Wiratai Santiprapop, the governor of the Bank of Thailand, said in August that the BoT’s goal is to use the CBDC in facilitating international transactions, verification of transactions that must be fast and have fixed fees.

“Central banks around the world have started to pilot their coins. In the future, digital currencies will be used instead of cash around the world,” said Wiratai .

Central banks weigh using CBDC for a payment network

SuperCryptoNews also reported on August 20 that several central banks around the world were developing Central Bank Digital Currency (CBDC) and testing the possibility of issuing internal cryptocurrencies including China, Singapore, Canada, and Thailand.

The People’s Bank of China (PBOC) has already announced its readiness to issue a cryptocurrency, while the Monetary Authority of Singapore (MAS) has partnered with the Bank of Canada to develop a more efficient way to conduct cross-border and cross-currency payments with the use of CBDC and Distributed Ledger Technology (DLT).

In addition, Sweden has Riksbank working under the “e-krona program” since the spring of 2017 in response to the reduced use of flat money. The Indian government is considering draft legislation that allows “Digital Rupee” to be considered as “legal tender”, and in this proposed bill, aside from this digital currency, all other cryptocurrencies will be banned.

A published report by the International Monetary Fund (IMF) in June explained that central banks globally have begun experimenting with CBDCs in hopes to reduce costs and increase the efficiency of monetary policies for cryptocurrency and more importantly, to build the competitiveness of the payment market and offer payment tools that are safer for public use.

You may also want to read:

- Bank of Thailand Developing Blockchain with Hong Kong Monetary Authority

- HKMA Conducts CBDC Research for Applications