Did you know that Ethereum (ETH) is nearly ten times its price at the end of January 2020? Believe it or not, ETH price was $164 on January 26, 2020, but it has now increased by 770 % to hit $1,428 on January 25, 2021, according to CoinMarketCap.

Isn’t this a remarkable bull run? Ethereum is continuously stamping its authority in the crypto space by showcasing its outstanding potential. January 2021 has seen ETH make record-breaking moves not seen for more than three years after it breached the all-time high (ATH) price of $1,400 it set in 2018.

You may be wondering why is Ethereum continuously making headlines? Without a doubt, ETH is emerging to be one of the most valuable entities worldwide, explaining why both retail and institutional investors are keeping a keen eye on the second-largest cryptocurrency based on market capitalization.

For instance, over the weekend, Ethereum soared to a new high of $1,460, making its market capitalization surge past the $160 billion mark. With this new milestone, ETH is now more valuable than various leading banks like Wells Fargo, HSBC, Bank of China, Citigroup, and SoftBank, among others.

What has been the engine behind Ethereum’s impressive bull run?

1. The launch of Ethereum 2.0

ETH has started 2021 on a high thanks to the unveiling of Ethereum 2.0 and a booming decentralized finance (DeFi) sector. Before the launch of ETH 2.0 in December last year, the crypto community had waited for it to go live with bated breath based on the proof-of-stake consensum mechanism it introduced.

The Ethereum network was accustomed to the proof-of-work framework, which required miners to carry out complex mathematical equations, with the winner getting the mandate to generate the next block.

Now the ETH blockchain will use a proof-of-stake mechanism, which is touted to be more environmentally friendly compared to mining because the next block’s validator is chosen on the foundation of the amount held or staked.

What does this mean? The rewards gained by validating blocks is based on how much Ethereum is staked in the network. Therefore, the more Ether you have on the blockchain, the more chances you have of generating blocks.

Scalability is the other advantage rendered by Ethereum 2.0 because of the energy-efficient solutions rendered when powering crypto transactions on the new mainnet.

This transition has aided Ethereum’s remarkable bull run as more investments continue being staked on Ethereum 2.0 despite it going live more than a month ago. For instance, data from on-chain market provider Dune Analytics shows that more than 2.8 million ETH have been staked and the number is growing by the day. These investment inflows have, therefore, pushed ETH’s price upwards as investors continue to show their overwhelming confidence in the second-biggest cryptocurrency.

An on-chain analyst named Ali Martinez noted that theoretically, ETH 2.0 has a likelihood of thrusting the price higher by reducing Ethereum’s velocity. He pointed out, “In theory, ETH 2.0 is negatively impacting the rate at which ETH can be exchanged for cash. As Ethereum’s velocity decreases, the higher the chances that its price will increase.”

Without a doubt, ETH 2.0 has been a notable driving force behind Ethereum’s current price surge.

2. Booming decentralized finance (DeFi) sector

The decentralized finance (DeFi) sector, which serves as the bridge between fiat currency and digital currencies has been booming, and this has aided Ethereum’s price surge. For instance, this field experienced a monumental growth of 2000% in 2020 given that by 1st January, the total value locked up stood at $0.67 billion, but this figure had skyrocketed to $14.74 billion by 1st December.

DeFi has been one of the most sought after areas because traditional financial applications (apps) are created using blockchain technology and a decentralized network. The Ethereum blockchain has crafted a name for itself in the DeFi industry based on high demand. Therefore, making its price surge higher.

The future looks bright for Ethereum

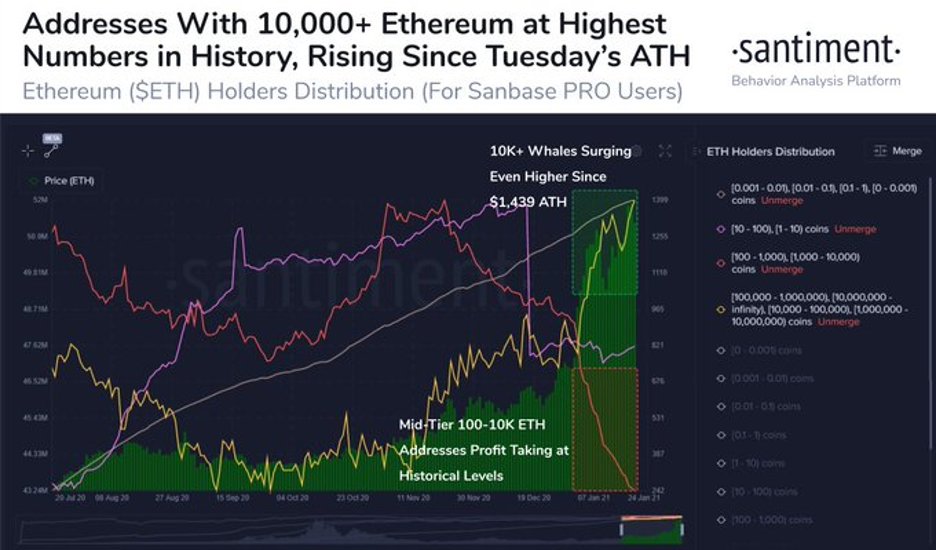

With Ethereum whales having broken the record as addresses with more than 10,000 hit 1,225, more investment inflows are overwhelmingly trickling in this network. Santiment, a crypto data provider, acknowledged that crypto whales were accumulating more Ethereum as the future looked bright.

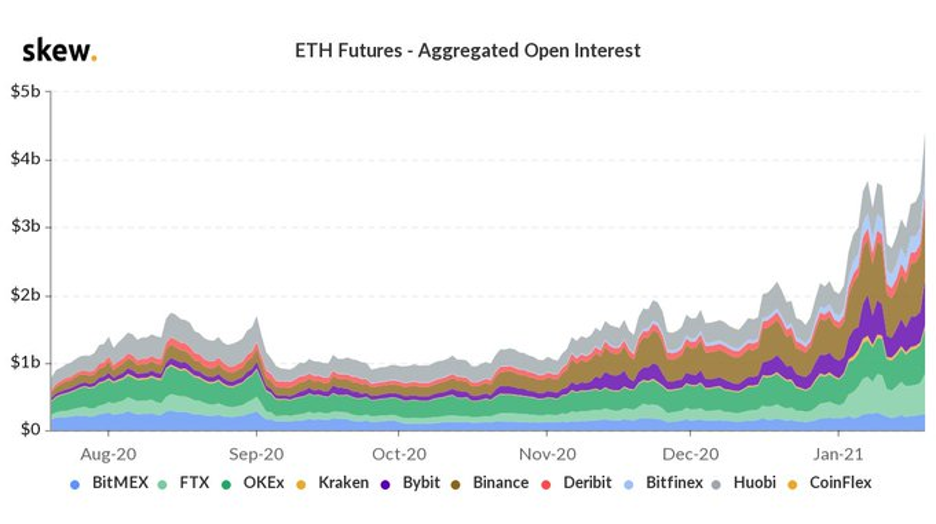

Furthermore, ETH’s open interest recently got to a record high of more than $4 billion, showing that more participants were eyeing this network.

These statistics, therefore, show that there is light at the end of the tunnel for Ethereum. Furthermore, various analysts have been offering positive remarks. For instance, Michael van de Poppe, a crypto analyst, recently revealed that he expects Ethereum price to go ballistic later on in 2021 because it looked great on the BTC pair.

Furthermore, Raoul Pal, a veteran Wall Street trader, disclosed that ETH was ready to skyrocket to $20,000 on the foundation of Metcalfe’s Law.

You should, therefore, consider joining the Ethereum bandwagon because it seems the sky’s the limit.

[ Read more: Top Five Reasons Ethereum May Hit US$5,000 by 2022 ]